Learn the definition, benefits, drawbacks, and factors to consider when choosing whole life insurance. Discover how to customize your policy for maximum protection.

Definition of Whole Life Insurance

Contents

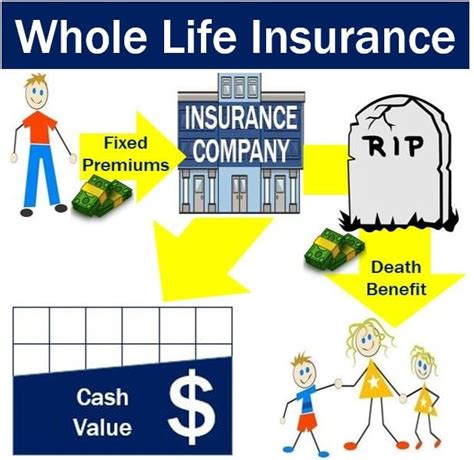

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of the policyholder’s life. Unlike term life insurance, which only covers a specific period of time, whole life insurance guarantees a death benefit to the policyholder’s beneficiaries, as long as the premiums are paid.

This type of insurance also includes a savings component, known as cash value, which grows over time and can be borrowed against or withdrawn by the policyholder. Whole life insurance is often considered an investment as well as a form of protection, as the cash value can be used to supplement retirement income or cover unexpected expenses.

Whole life insurance premiums are typically higher than those of term life insurance, as they are designed to cover the insured for their entire lifetime. However, the benefits of whole life insurance, such as the guaranteed death benefit and potential for cash value growth, can make it a valuable financial tool for some individuals and families.

It’s important to carefully consider the costs and benefits of whole life insurance, as well as how it fits into your overall financial plan, before deciding whether it’s the right choice for you.

Benefits of Whole Life Insurance

Whole life insurance offers a variety of benefits that make it an attractive option for many individuals. One of the key benefits of whole life insurance is the guaranteed cash value that builds up over time. This cash value can be used as collateral for a loan, or even withdrawn to supplement retirement income. Additionally, whole life insurance provides permanent coverage that does not expire as long as premiums are paid, providing peace of mind to policyholders and their loved ones.

Another major benefit of whole life insurance is the tax advantages it offers. The cash value that accumulates in the policy grows tax-deferred, meaning it is not subject to income tax. Furthermore, the death benefit paid out to beneficiaries is generally income tax-free, providing a financial safety net for loved ones.

Whole life insurance also offers dividend payments to policyholders who participate in a mutual company. These payments can be used to purchase additional coverage, reduce premium payments, or even receive as cash. This added source of income can be a valuable asset for policyholders looking to bolster their financial security.

Finally, whole life insurance can serve as a valuable estate planning tool. The death benefit can help cover estate taxes or provide an inheritance for loved ones, ensuring that the policyholder’s legacy continues beyond their lifetime. This can be particularly advantageous for individuals with substantial assets or business interests.

Drawbacks of Whole Life Insurance

When considering whole life insurance, it is important to be aware of the drawbacks that come with this type of policy. One of the main drawbacks is the cost. Whole life insurance premiums are typically much higher than term life insurance premiums, making it more difficult for some individuals to afford. Additionally, the cash value of the policy may not grow as quickly as anticipated, leading to an inaccurate projection of investment return.

Another potential drawback of whole life insurance is the lack of flexibility. Unlike term life insurance, whole life policies do not offer the same level of customization and the premiums and death benefits are often set in stone, leaving little room for adjustment. This lack of flexibility can be a turn-off for individuals who want more control over their insurance policy.

Furthermore, the complexity of whole life insurance can also be seen as a drawback. The nature of the investment component of the policy can be confusing for some individuals, leading to a lack of understanding about how the policy works and what the potential risks may be. This complexity can lead to frustration and may deter some people from considering whole life insurance as a viable option.

Lastly, the opportunity cost of investing in a whole life insurance policy must also be taken into account. By tying up funds in a whole life policy, individuals may be missing out on other potentially more lucrative investment opportunities. This can be especially troubling for those who are looking for ways to maximize their financial assets and may feel restricted by the long-term commitment of a whole life policy.

Factors to Consider When Choosing Whole Life Insurance

When deciding on a whole life insurance policy, there are several factors to take into consideration. It’s important to carefully evaluate the options available to ensure that you choose the right policy for your specific needs.

First and foremost, take a close look at the premiums associated with the policy. Whole life insurance typically has higher premiums compared to term life insurance, so it’s essential to assess whether the premium amount fits within your budget. Consider how the premium payments will fit into your long-term financial planning.

Another important factor to consider is the cash value component of the policy. Whole life insurance policies accumulate cash value over time, which can be used as a source of savings or borrowed against. It’s crucial to understand how the cash value grows and how it can benefit you in the future.

Additionally, the death benefit is a critical component to consider when selecting a whole life insurance policy. This is the amount paid out to your beneficiaries upon your passing. It’s essential to determine how much coverage you need to adequately provide for your loved ones in the event of your death.

Lastly, it’s important to assess the financial stability and reputation of the insurance company offering the whole life insurance policy. Look into the company’s track record, customer reviews, and ratings from independent agencies to ensure that you are choosing a reliable and trustworthy insurance provider.

How to Customize Whole Life Insurance

When it comes to whole life insurance, one size does not fit all. That’s why it’s important to understand how to customize your whole life insurance policy to meet your specific needs and goals. Here are some important factors to consider when customizing your whole life insurance policy.

First and foremost, you’ll want to determine the right coverage amount for your whole life insurance policy. This will depend on factors such as your current income, future financial obligations, and any outstanding debts. By customizing the coverage amount, you can ensure that your loved ones are adequately protected in the event of your passing.

Next, consider the premium payment schedule that works best for you. Whole life insurance policies offer flexibility when it comes to premium payments, allowing you to choose a schedule that aligns with your financial situation. Customizing your premium payments can help you budget more effectively while still maintaining the benefits of whole life insurance.

Additionally, look into the option to add riders to your whole life insurance policy. Riders are additional features or benefits that can be included in your policy to enhance its coverage. Common riders include accelerated death benefits, guaranteed insurability, and long-term care benefits. By customizing your policy with riders, you can tailor it to better suit your unique needs and preferences.

Lastly, consider working with a knowledgeable insurance agent to help you customize your whole life insurance policy. An experienced agent can provide valuable insights and guidance as you navigate the process of customizing your policy, ensuring that you make informed decisions that align with your long-term financial goals.