Discover the benefits, risks, and investment options of unit-linked insurance. Learn how to choose the right plan for your financial needs.

Understanding Unit-Linked Insurance

Contents

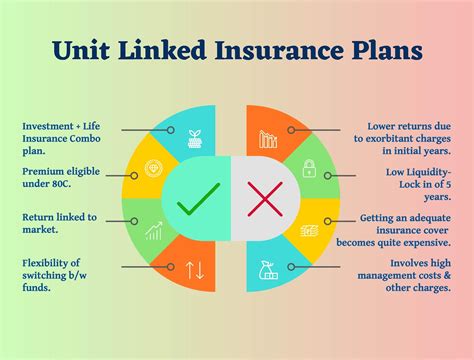

Unit-linked insurance is a type of insurance that combines both protection and investment. When you invest in a unit-linked insurance policy, a part of your premium goes towards providing insurance coverage, while the remaining amount is invested in various market-linked instruments such as stocks, bonds, or mutual funds.

This means that the value of your investment is directly linked to the performance of these underlying assets. Therefore, the returns on a unit-linked insurance policy are not fixed and can vary based on the market conditions.

One of the key features of unit-linked insurance is the flexibility it offers to policyholders. Unlike traditional insurance policies, unit-linked plans allow policyholders to switch between different investment funds based on their risk appetite and financial goals.

Another important aspect to understand is the charges associated with unit-linked insurance. These charges include premium allocation charges, policy administration charges, fund management charges, mortality charges, and surrender charges. It’s essential to carefully review these charges before investing in a unit-linked insurance policy.

Overall, unit-linked insurance provides a unique blend of insurance protection and investment opportunity, making it a popular choice for individuals looking to secure their financial future while also participating in the potential growth of the financial markets.

Benefits of Unit-Linked Insurance

Unit-linked insurance plans offer a range of benefits that make them an attractive investment option for many individuals. One of the main advantages of unit-linked insurance is the flexibility it provides in terms of investment choices. Policyholders have the freedom to choose from a variety of funds based on their risk appetite and financial goals.

Another key benefit of unit-linked insurance is the opportunity for wealth creation. As the policyholder’s premiums are invested in the chosen funds, there is potential for higher returns compared to traditional insurance policies. This can be especially beneficial for individuals looking to grow their wealth over the long term.

Additionally, unit-linked insurance plans offer tax benefits to policyholders. The premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act, providing an incentive for individuals to invest in these plans and save on their tax liabilities.

Furthermore, unit-linked insurance plans provide protection to policyholders and their families in the form of a life cover. In the event of the policyholder’s demise, the beneficiary receives a lump sum amount, ensuring financial security and support during challenging times.

In summary, the benefits of unit-linked insurance, such as investment flexibility, wealth creation potential, tax advantages, and financial protection, make it a valuable and versatile financial product for individuals seeking to secure their future and maximize their returns.

Investment Options in Unit-Linked Insurance

When it comes to unit-linked insurance, there are several investment options available for policyholders to choose from. These options typically include a range of mutual funds, stocks, bonds, and other investment vehicles, allowing policyholders to tailor their investment strategy to their individual financial goals and risk tolerance.

One of the key benefits of unit-linked insurance is the flexibility it offers in terms of investment choices. Policyholders can often switch between different investment options within their policy, allowing them to adapt to changing market conditions or personal financial objectives.

Some unit-linked insurance plans also offer a variety of investment funds managed by financial professionals, giving policyholders access to expert investment management and diversification across different asset classes.

Additionally, policyholders may have the opportunity to allocate their premiums across different investment options, allowing them to create a customized investment portfolio within their insurance policy.

Risks and Considerations of Unit-Linked Insurance

When considering unit-linked insurance, it is important to be aware of the potential risks and considerations involved. One of the primary risks associated with this type of insurance is the fluctuation of the market. Since the value of the investment component is linked to the performance of underlying assets, there is a risk of loss if the market experiences a downturn. Additionally, unit-linked insurance plans may come with higher fees and charges compared to traditional insurance policies, which can impact the overall return on investment.

Another important consideration is the level of flexibility and control that unit-linked insurance offers. While this type of insurance provides the opportunity to tailor the investment component to suit individual preferences, it also requires a higher level of involvement and decision-making on the part of the policyholder. This can be a double-edged sword, as it allows for greater potential for growth but also exposes the policyholder to the risks associated with investment decisions.

Furthermore, it is essential to carefully assess and understand the terms and conditions of the policy, including any potential penalties for early termination or changes to the investment allocation. Policyholders should also be aware of the potential impact of taxes on the investment component of the insurance policy, as well as the potential consequences of surrendering the policy before its maturity date.

It is important for individuals to thoroughly evaluate their risk tolerance and financial objectives before committing to a unit-linked insurance plan. While these policies offer the potential for higher returns and investment growth, they also come with a higher level of risk and complexity. It is advisable to seek professional financial advice to ensure that the chosen unit-linked insurance plan aligns with the individual’s long-term financial goals and risk tolerance.

How to Choose the Right Unit-Linked Insurance Plan

When it comes to choosing the right unit-linked insurance plan, there are several important factors to consider. It’s crucial to carefully evaluate your financial goals and risk tolerance before making a decision. Understanding the investment options and benefits of unit-linked insurance can help you make an informed choice.

One of the key considerations when choosing a unit-linked insurance plan is the investment options available. Different plans offer various investment funds, such as stocks, bonds, and mutual funds. It’s essential to assess the performance and track record of these funds to determine which ones align with your investment objectives.

Additionally, it’s important to carefully evaluate the risks associated with unit-linked insurance plans. While they offer the potential for higher returns compared to traditional insurance policies, they also come with market-related risks. Understanding these risks and considering your risk tolerance is crucial in choosing the right plan.

Another vital factor to consider is the benefits offered by the unit-linked insurance plan. These may include options for partial withdrawals, tax benefits, and the flexibility to switch between investment funds. Evaluating the various benefits can help you determine which plan best fits your financial needs and objectives.

Ultimately, choosing the right unit-linked insurance plan requires careful consideration of your financial goals, risk tolerance, investment options, risks, and benefits. It’s important to thoroughly research and compare different plans to make an informed decision that aligns with your long-term financial objectives.