Discover the importance of life insurance and how to choose the right policy. Learn about different types and factors affecting premiums.

Understanding Life Insurance

Contents

Life insurance is a financial product designed to provide a financial safety net for your loved ones in the event of your death. It is a contract between the policyholder and the insurance company, where the policyholder pays regular premiums in exchange for a sum of money paid to the beneficiaries upon the policyholder’s death. This financial protection can help cover funeral expenses, pay off debts, and replace lost income.

There are several types of life insurance policies, including term life, whole life, and universal life. Each type offers different features and benefits, so it’s important to carefully consider your financial needs and goals before choosing a policy.

When considering life insurance, it’s essential to understand the factors affecting life insurance premiums. These may include your age, gender, health, occupation, and lifestyle choices. All of these variables can impact the cost of your policy, so it’s important to be aware of how they can affect your coverage and premiums.

Having life insurance is crucial for anyone who has loved ones who depend on their income. It provides peace of mind knowing that your family will be financially secure if something were to happen to you. Without life insurance, your loved ones could be left struggling to cover expenses and maintain their quality of life.

Choosing the right life insurance policy is a significant decision and requires careful consideration. It’s crucial to evaluate your needs and research different options to find the best fit for you and your family. By understanding life insurance and its various components, you can make an informed decision that provides the greatest financial protection for your loved ones.

Types of Life Insurance Policies

Types of Life Insurance Policies

When it comes to life insurance, there are a few different options to consider. The two most common types of life insurance policies are term life insurance and whole life insurance.

Term life insurance is the simplest form of life insurance. It provides coverage for a specified period of time, usually 10, 20, or 30 years. This type of policy is typically less expensive than whole life insurance because it does not build cash value over time. It is a good option for those who need coverage for a specific period, such as to protect a mortgage or to provide for children until they are grown.

Whole life insurance, on the other hand, is a permanent form of life insurance that provides coverage for the entire lifetime of the insured. In addition to providing a death benefit, whole life insurance also accumulates a cash value over time, which can be borrowed against or used to pay premiums. This type of policy is more expensive than term life insurance, but it offers the security of knowing that coverage will be in place for the rest of the insured’s life.

In addition to term and whole life insurance, there are also other types of life insurance policies such as universal life insurance and variable life insurance. These policies offer different features and benefits, so it’s important to carefully consider your needs and goals before choosing a policy.

It’s important to compare life insurance policies to determine the best fit for your needs and financial situation. Consider factors such as the length of coverage, premium costs, and cash value accumulation when evaluating your options.

Factors Affecting Life Insurance Premiums

Factors Affecting Life Insurance Premiums

Life insurance premiums are not set in stone. There are several factors that can impact the cost of your life insurance policy. Understanding these factors can help you make informed decisions when purchasing a life insurance policy.

One of the main factors that can affect your life insurance premium is your age. Age plays a big role in determining the cost of your life insurance policy. Generally, the younger you are when you purchase a policy, the lower your premium will be. This is because younger individuals are typically considered to be at a lower risk of passing away compared to older individuals.

Another important factor that can impact your life insurance premium is your health. Insurance companies will assess your overall health when determining the cost of your policy. Individuals with pre-existing medical conditions or those who engage in high-risk behaviors such as smoking are generally considered to be at a higher risk and may face higher premiums as a result.

Additionally, your lifestyle can also influence the cost of your life insurance premiums. If you have a dangerous occupation or engage in hazardous activities, such as extreme sports, insurance companies may view you as a higher risk and adjust your premium accordingly.

Finally, the type and amount of coverage you choose will also impact your life insurance premium. Policies with higher coverage amounts or additional riders will generally come with higher premiums. It’s important to carefully consider your coverage needs and budget when selecting a policy.

Importance of Having Life Insurance

Importance of Having Life Insurance

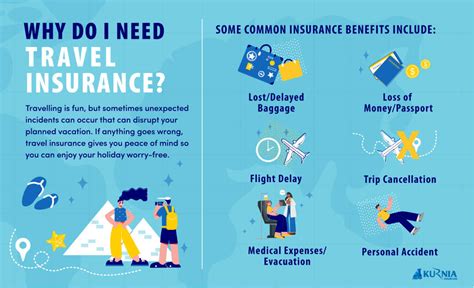

Life insurance is a crucial financial safety net that everyone should consider securing. It offers protection and peace of mind to you and your loved ones, providing financial security and stability in the event of your unexpected passing. Life insurance can be a lifeline for your family, serving as a source of income replacement, covering outstanding debts, and funding future expenses such as college tuition or retirement savings.

Having life insurance means that your family will not have to worry about facing financial hardships in addition to the emotional distress of losing a loved one. It can provide a level of financial protection that offers comfort during a difficult time, allowing your family to focus on healing and rebuilding their lives without the added stress of financial burdens.

Additionally, life insurance can also be a valuable tool for estate planning, providing funds for estate taxes, ensuring a smooth transfer of assets, and preserving generational wealth for your beneficiaries. It offers a way to protect and secure your legacy, ensuring that your loved ones are taken care of and that your wishes are honored.

| Benefits of Having Life Insurance | Reasons to Consider Life Insurance |

|---|---|

| Financial security and stability for your family | Protecting your loved ones from financial burdens |

| Income replacement and covering outstanding debts | Valuable tool for estate planning and preserving generational wealth |

| Source of funds for future expenses such as college tuition or retirement savings | Peace of mind and comfort during a difficult time |

In conclusion, having life insurance is essential for ensuring the financial well-being of your loved ones and protecting your legacy. It offers a range of benefits and serves as a valuable tool for securing your family’s future. By obtaining the right life insurance policy, you can provide a level of financial security and peace of mind that is invaluable in protecting your loved ones and honoring your wishes.

Choosing the Right Life Insurance Policy

When it comes to choosing the right life insurance policy, there are several factors to consider in order to make the best decision for you and your family. The first step is to assess your needs and financial situation. Consider how much coverage you need, how long you need it, and what you can afford to pay in premiums. This will help you narrow down your options and choose the policy that best meets your needs.

Next, it’s important to understand the different types of life insurance policies available. Term life insurance offers coverage for a specific period of time, while whole life insurance provides coverage for your entire life. There are also variations of these policies, such as universal life and variable life insurance, each with their own unique features and benefits. Take the time to research and compare the different types of policies to determine which one aligns with your needs and goals.

Another important consideration when choosing a life insurance policy is the financial stability and reputation of the insurance company. Look for a company that has a strong financial rating and a history of paying out claims in a timely manner. This will give you peace of mind knowing that your loved ones will be taken care of in the event of your passing.

In addition, it’s crucial to consider any additional features or riders that may be available with a life insurance policy. Some policies offer options for accelerated death benefits, which allow you to access a portion of the death benefit if you are diagnosed with a terminal illness. Other policies may offer options for long-term care benefits or the ability to add additional coverage in the future without undergoing a medical exam.

Ultimately, choosing the right life insurance policy involves careful consideration of your individual needs, as well as a thorough understanding of the options available. By taking the time to research and compare policies, and seeking guidance from a professional if needed, you can make an informed decision that provides you and your loved ones with the financial protection and security you need.