Learn about the importance, benefits, and factors to consider for key person insurance. Find out who qualifies and why it’s crucial for your business.

Understanding Key Person Insurance

Contents

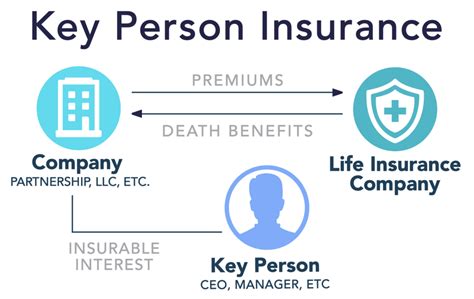

Key person insurance is a type of life insurance policy taken out by a company on one of its employees or owners, to compensate that company for financial losses that would arise from the death or disability of the person who is insured.

This insurance can be crucial for small businesses and startups, as the loss of a key person can have a significant impact on the overall operations and financial stability of the company.

Key person insurance is often used to protect companies from the risks associated with losing a key executive, salesperson, or someone else whose absence would result in a significant financial loss.

This type of insurance can be used to cover the costs of finding and training a replacement, compensating for lost profits, and reassuring creditors or investors who may be concerned about the financial impact of the loss of a key person.

Importance of Key Person Insurance

Key person insurance is a crucial aspect of business planning and risk management. This type of insurance provides protection for a business in the event that a key employee or executive, whose skills, knowledge, or leadership are essential to the company’s success, becomes unable to work due to death or disability.

Having key person insurance in place can provide financial support to help the business survive during the difficult transition period following the loss of a key individual. This can include covering the costs of recruiting and training a replacement, reassuring creditors and customers, and providing stability to the business during a challenging time.

Without key person insurance, a business may face significant financial strain and instability if a key person were to unexpectedly leave the company. The financial impact of such a loss could be devastating, potentially leading to the disruption or even closure of the business.

Furthermore, having key person insurance coverage can also make a business more attractive to potential investors or lenders, as it demonstrates a proactive approach to managing risk and ensuring the continued success of the company.

Who Qualifies as a Key Person?

Key person insurance is designed to protect a business from the financial impact of losing a key employee or executive. But who exactly qualifies as a key person? In general, a key person is someone whose absence would have a significant impact on the financial health and stability of the company. This could be a founder, a top salesperson, a key manager, or anyone else who plays a critical role in the company’s success.

One way to determine who qualifies as a key person is to consider the value that person brings to the business. This could be in the form of specific skills, expertise, industry knowledge, or a strong network of contacts and clients. A key person is someone who is central to the company’s operations and success, and their absence would be felt acutely.

Another factor to consider is the role the individual plays within the organization. A key person is typically someone who has a direct impact on the company’s revenue or profits, or whose absence would result in a disruption to business operations. This could include individuals who have specialized knowledge, crucial leadership skills, or key client relationships.

It’s important to note that the definition of a key person can vary depending on the size and industry of the company. Small businesses may have different criteria for determining who qualifies as a key person compared to larger corporations. Ultimately, the key person is someone whose absence would create a significant financial risk for the company.

Factors to Consider for Coverage

When considering key person insurance for your business, there are several factors that you should take into account to ensure that you have the appropriate coverage. One of the first factors to consider is the value of the key person to your business. This involves assessing the individual’s unique skills, experience, and contribution to the overall success of the company.

Another important factor to consider is the potential financial impact that the loss of the key person could have on the business. This includes the costs associated with finding and training a replacement, as well as any potential loss of revenue or clients that could result from the key person’s absence.

Additionally, it’s crucial to assess the current insurance coverage of the key person to determine if there are any gaps that need to be filled. This includes reviewing any existing life, disability, or health insurance policies to ensure that they are sufficient to cover the financial impact of the key person’s absence.

Furthermore, the size and structure of your business should also be taken into consideration when determining the amount of coverage needed. A larger company with more employees and higher revenue may require a greater amount of coverage compared to a smaller business.

Lastly, it’s important to carefully review the terms and conditions of the key person insurance policy to ensure that it aligns with the specific needs and goals of your business. This includes understanding the coverage limits, premium costs, and any exclusions or limitations that may apply.

Benefits of Key Person Insurance

Key person insurance is a crucial investment for any business, providing financial protection in the event of the death or incapacitation of a key employee. This type of insurance policy ensures that the business can continue to operate smoothly by providing funds to cover the loss of income, recruiting and training a replacement, and reassuring stakeholders.

Additionally, key person insurance can be used as a financial safety net to pay off debts or provide business partners with a buyout option in the event of the death of a key person within the company.

Having key person insurance can also boost the confidence of creditors and investors, as it demonstrates that the business is prepared for unexpected events and has a plan in place to mitigate risks. This can open doors to opportunities for financing and partnerships that may not have been available otherwise.

Furthermore, the policy’s cash value buildup can be utilized to fund employee benefit plans or to provide retirement income for the key person. This creates an additional incentive for key employees to stay with the company and contribute to its success, thereby enhancing retention and morale within the organization.

In conclusion, the benefits of key person insurance are vast, ranging from ensuring business continuity to securing financial stability and creating strategic advantages in the marketplace. Investing in key person insurance is a proactive measure that can safeguard the future of the business and provide peace of mind for all stakeholders.