Find the right expatriate insurance plan with coverage options, benefits, and debunking misconceptions. Understand expatriate insurance today.

Understanding Expatriate Insurance

Contents

Expatriate insurance refers to the insurance coverage provided to individuals who are living and working in a country other than their own. This type of insurance is specifically designed to meet the unique needs of individuals living as expatriates, providing coverage for healthcare, medical emergencies, and other specific needs that may arise while living abroad. Expatriate insurance plans are tailored to the needs of expatriates, offering a range of coverage options to suit different requirements.

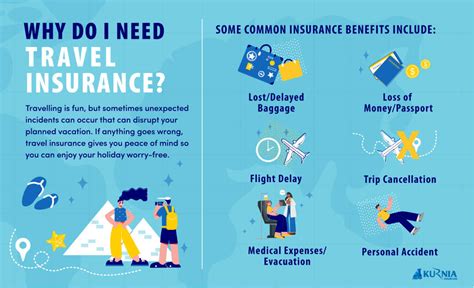

One of the key elements of expatriate insurance is the coverage options that are available. These can include medical coverage, emergency medical evacuation, repatriation of remains, trip interruption, and other benefits. Expatriate insurance plans are highly customizable, allowing individuals to choose the specific coverage options that best meet their needs. This flexibility is particularly important for expatriates, who may have unique healthcare needs and face specific risks while living abroad.

There are several benefits to having expatriate insurance, including access to quality healthcare, financial protection in the event of a medical emergency, and peace of mind for both the expatriate and their family members. Expatriate insurance also provides access to a network of healthcare providers and medical facilities, ensuring that individuals can receive the care they need while living abroad. Additionally, expatriate insurance can provide coverage for pre-existing conditions, allowing individuals to continue receiving the care they need while living in a different country.

When choosing an expatriate insurance plan, it’s important to carefully consider the specific needs of the individual and their family members. This includes evaluating the coverage options available, the cost of the plan, and any limitations or restrictions that may apply. By choosing the right expatriate insurance plan, individuals can ensure that they have the coverage they need to protect their health and well-being while living abroad. It’s important to carefully review the terms and conditions of any expatriate insurance plan to ensure that it meets the specific needs of the individual and their family.

In conclusion, expatriate insurance is an essential consideration for individuals who are living and working abroad. Understanding the coverage options, benefits, and considerations involved in choosing an expatriate insurance plan is crucial for ensuring that individuals have the protection they need while living as expatriates. By carefully evaluating their needs and choosing the right expatriate insurance plan, individuals can have peace of mind knowing that they have the necessary coverage to protect their health and well-being while living in a foreign country.

Coverage Options for Expatriate Insurance

Expatriate insurance is a crucial consideration for individuals living and working abroad. When it comes to coverage options for expatriate insurance, it is important to understand the various types of coverage available to ensure that you have the necessary protection in place.

One option for expatriate insurance coverage is international medical insurance. This type of coverage provides access to medical care and treatment while living outside of your home country. It is important to review the specific benefits and coverage limits of international medical insurance to ensure that it meets your individual needs.

Another important aspect of coverage options for expatriate insurance is emergency medical evacuation and repatriation. This coverage provides assistance and resources for transportation to a medical facility or to return to your home country in the event of a medical emergency. Understanding the details of this coverage is essential for expatriates living and working abroad.

Additionally, expatriate insurance coverage options may include personal property and liability coverage. This can provide protection for personal belongings and assets, as well as liability protection in the event of legal claims or disputes. It is important to assess your individual risk and needs to determine the appropriate level of personal property and liability coverage.

Overall, expatriate insurance coverage options are designed to provide essential protection for individuals living and working abroad. It is important to carefully review and consider the specific coverage options available to ensure that you have the necessary protection in place for your unique expatriate experience.

Benefits of Expatriate Insurance

Expatriate insurance provides a wide range of benefits for individuals living and working abroad. One of the key benefits is access to quality healthcare services in the host country. By having expatriate insurance, individuals can avoid the high costs associated with medical emergencies and regular health check-ups. This not only provides peace of mind but also ensures that expatriates can access the healthcare services they need without any financial burden.

Another important benefit of expatriate insurance is the coverage for emergency medical evacuation. In the event of a serious illness or injury, expatriate insurance can cover the costs of transporting the individual to a medical facility where they can receive appropriate treatment. This can be a lifesaving benefit for expatriates living in remote or underdeveloped areas where access to advanced medical care is limited.

Expatriate insurance also provides coverage for repatriation in the unfortunate event of the death of an expatriate. This includes the costs associated with returning the deceased individual’s remains to their home country. This benefit provides reassurance to expatriates and their families, knowing that they will be taken care of in such a difficult time.

Additionally, expatriate insurance often includes coverage for personal liability, including legal expenses, as well as assistance services such as emergency travel assistance and concierge services. These benefits can be invaluable for expatriates who may face unique challenges and risks while living and working in a foreign country.

Choosing the Right Expatriate Insurance Plan

Expatriate insurance plans are crucial for individuals living and working abroad. It provides protection and peace of mind for expatriates, ensuring that they have access to quality healthcare wherever they are in the world. When it comes to choosing the right expatriate insurance plan, there are several factors to consider.

First and foremost, expatriates must assess their specific needs and requirements. This includes considering their medical history, any pre-existing conditions, and the countries they will be residing in. Understanding coverage options is essential to ensure that the chosen plan provides adequate protection.

Another important aspect to consider is the network of healthcare providers available within the insurance plan. Expatriates should ensure that the plan they choose offers access to a wide network of hospitals, clinics, and healthcare professionals, especially in the areas they are likely to reside or visit frequently.

It’s also crucial to consider the benefits offered by the expatriate insurance plan. This includes emergency medical evacuation, coverage for chronic conditions, mental health support, and preventive care services. Expatriates should carefully review the benefits of each plan to ensure that it aligns with their specific needs.

Lastly, many expatriates may have common misconceptions about expatriate insurance, leading them to believe that they are sufficiently covered under a standard travel insurance plan. It’s important to dispel these myths and educate expatriates on the importance of choosing a comprehensive expatriate insurance plan that provides the necessary coverage for their unique circumstances.

Common Misconceptions about Expatriate Insurance

Expatriate insurance is often misunderstood and there are several misconceptions surrounding it. One common misconception is that expatriate insurance is only for long-term expats. In reality, expatriate insurance plans are available for short-term and long-term assignments, as well as for those who are planning to work or live abroad for a few months to a few years.

Another misconception is that expatriate insurance is not necessary if the host country has a public healthcare system. While some countries may have a public healthcare system in place, it may not be easily accessible to expatriates or may not provide the level of coverage they need. Expatriate insurance can fill in the gaps and provide comprehensive coverage for medical care while living abroad.

Some people also mistakenly believe that expatriate insurance is too expensive. In reality, there are a wide range of expatriate insurance plans available, with varying levels of coverage and cost. With careful research and consideration, expatriates can find a plan that fits their budget and provides the coverage they need.

Additionally, there is a misconception that expatriate insurance only covers medical emergencies. While medical coverage is a key component of expatriate insurance, many plans also include benefits such as preventive care, wellness programs, and coverage for pre-existing conditions.

It’s important to shed light on these misconceptions and educate expatriates about the benefits and options available to them through expatriate insurance. By understanding the true nature of expatriate insurance, individuals can make informed decisions about their coverage while living and working abroad.