Discover the benefits and workings of endowment insurance, and learn how to choose the right policy and maximize returns for a secure financial future.

Understanding Endowment Insurance

Contents

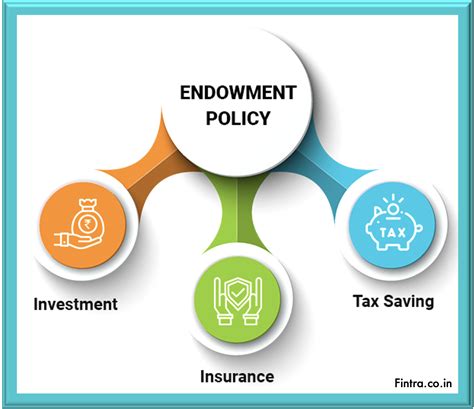

Endowment insurance is a type of life insurance policy that provides both a death benefit and a savings or investment component. The premiums paid for an endowment insurance policy are invested by the insurance company and typically grow over time, creating a cash value that can be accessed by the policyholder. This type of policy is often used as a way to save money for future goals or to provide financial security for loved ones in the event of the policyholder’s death.

One of the key features of endowment insurance is that it provides a guaranteed payout, known as the death benefit, to the policyholder’s beneficiaries upon the policyholder’s death. This can provide peace of mind and financial security to the policyholder’s loved ones, knowing that they will be taken care of in the event of a tragedy.

Additionally, the cash value component of an endowment insurance policy can be accessed by the policyholder during his or her lifetime. This can provide a source of funds for important life events, such as buying a home, paying for college, or starting a business. The policyholder can also choose to borrow against the cash value of the policy, using it as a form of personal loan.

It’s important to note that endowment insurance policies can vary widely in terms of their structure, benefits, and potential returns. Policyholders should carefully consider their financial goals and needs when choosing an endowment insurance policy and work with a trusted financial advisor to find the right policy for them.

Benefits of Endowment Insurance

Endowment insurance offers many benefits to policyholders. One of the main benefits is the guarantee of a lump sum payout at the end of the policy term, which can provide financial security and stability for the policyholder and their family. This lump sum can be used for various purposes such as paying off a mortgage, funding a child’s education, or supplementing retirement income.

Another benefit of endowment insurance is the opportunity to grow the policy’s cash value over time. The cash value of the policy accumulates on a tax-deferred basis, which means that policyholders can enjoy tax-free growth on their investment. This can be especially advantageous for those looking to build a nest egg for the future.

Endowment insurance also offers the flexibility to customize the policy to meet individual financial goals and needs. Policyholders can choose the coverage amount, policy term, and premium payment schedule that best suits their circumstances. This can provide peace of mind knowing that the policy is tailored to their specific requirements.

Additionally, endowment insurance can serve as a form of forced savings, helping policyholders to develop a disciplined approach to saving and investing. The regular premium payments required by the policy can act as a savings mechanism, ensuring that funds are set aside for the future.

In summary, the benefits of endowment insurance include the guaranteed lump sum payout, potential for cash value growth, policy customization options, and the opportunity for disciplined savings. These features make endowment insurance a valuable financial tool for individuals and families looking to secure their financial future.

How Endowment Insurance Works

Endowment insurance is a type of life insurance that not only provides a death benefit, but also accumulates a cash value over time. Understanding how endowment insurance works can help you make informed decisions about your financial future.

When you purchase an endowment insurance policy, you agree to pay a regular premium to the insurance company. A portion of this premium goes towards the death benefit, while the rest is invested by the insurance company to generate returns. Over time, the cash value of the policy grows, and you may have the option to access this cash value through withdrawals or policy loans.

One of the key features of endowment insurance is the guaranteed maturity benefit. This means that if the policyholder survives the endowment period, which is typically a predetermined number of years, they are entitled to receive the accumulated cash value as a lump sum payment. This provides a level of financial security and can be used for various purposes such as funding retirement or paying off a mortgage.

It’s important to note that endowment insurance is a long-term commitment, and surrendering the policy prematurely may result in financial penalties. Additionally, the returns on the cash value are dependent on the performance of the investments made by the insurance company, so there is an element of risk involved.

In summary, endowment insurance works by combining life insurance coverage with a savings component. It offers the potential for growth of the cash value over time and provides a guaranteed payout if the policyholder outlives the endowment period. Understanding the mechanics of endowment insurance can help individuals make informed decisions about their insurance and financial planning.

Choosing the Right Endowment Insurance

When it comes to choosing the right endowment insurance, there are a few key factors to consider. The first step is to determine your financial goals and needs. Are you looking for a policy that offers guaranteed returns, or are you more interested in the potential for higher investment returns? Understanding your financial objectives is crucial in selecting the right endowment insurance for you.

Next, it’s important to consider the length of the endowment policy. Endowment insurance policies typically have longer terms, ranging from 10 to 30 years. Consider your financial goals and the length of time you’d like to invest in the policy when making your decision.

Additionally, it’s vital to evaluate the reputation and financial stability of the insurance provider. Look for a company with a strong track record of financial stability and reliable customer service. Researching the insurance provider’s ratings and reviews can provide valuable insight into their trustworthiness.

Finally, compare the features and benefits of different endowment insurance policies. Some policies may offer additional benefits such as critical illness coverage or flexible premium payment options. Understanding the unique features of each policy will help you choose the one that aligns with your financial goals and offers the most value.

Maximizing Returns with Endowment Insurance

When it comes to financial planning, many individuals are looking for ways to maximize their returns while minimizing risk. One option that can help achieve this goal is endowment insurance. This type of insurance not only provides a death benefit, but also offers a savings component that can accumulate cash value over time.

With endowment insurance, policyholders have the opportunity to benefit from potential investment gains, all while enjoying the peace of mind that comes with knowing their loved ones are financially protected in the event of their passing. This can make it an attractive option for those who want to grow their wealth while safeguarding their family’s financial future.

One key way to maximize returns with endowment insurance is to carefully consider the policy’s maturity date. This is the date when the policy’s cash value becomes available to the policyholder. By strategically choosing a maturity date that aligns with financial goals, individuals can ensure that they are able to access their funds when they are needed most.

Additionally, it’s important to regularly review and adjust the policy’s investment allocation. By working with a financial advisor, policyholders can make informed decisions about where their contributions are being allocated, maximizing their potential for returns and ensuring that their investment strategy remains in line with their long-term financial objectives.

Furthermore, staying informed about the financial markets and economic conditions can help policyholders make well-informed decisions about when to adjust their investment strategies. By monitoring market trends and staying proactive, individuals can maximize their returns and make the most of their endowment insurance policy.