Discover the benefits of accident insurance, understand different coverage types, and learn how to choose the right policy and make a claim.

Understanding Accident Insurance

Contents

Accident insurance is a type of insurance coverage that provides financial protection in the event of unexpected accidents. Unlike other types of insurance like health or auto insurance, accident insurance is specifically designed to cover the costs associated with accidents, regardless of whether they occur at work, at home, or while participating in recreational activities. This type of insurance can help to cover medical expenses, lost income, and other costs that may arise as a result of an accident.

One of the key benefits of accident insurance is that it can provide a financial safety net in the event of an unexpected accident. Many people don’t realize the potential financial impact of an accident until they are faced with one. Accident insurance can help to alleviate some of the financial stress and uncertainty that can arise from an accident, allowing individuals to focus on their recovery without worrying about the costs associated with their care.

There are several types of accident insurance coverage available, each designed to offer different levels of protection. Some policies may cover only medical expenses, while others may also provide coverage for lost income, rehabilitation costs, and other related expenses. It’s important to carefully review the details of each policy to understand what is covered and what is not, so that you can choose the right level of coverage for your needs.

Choosing the right accident insurance policy is an important decision that requires careful consideration. It’s important to consider factors such as the cost of the policy, the level of coverage provided, and any restrictions or limitations that may apply. Comparing quotes from different insurance providers and carefully reviewing the terms and conditions of each policy can help you to make an informed decision that meets your specific needs and budget.

In the event of an accident, making a claim for accident insurance involves following the specific procedures outlined in your policy. This may involve notifying your insurance provider of the accident, providing documentation of the expenses you have incurred, and following any other instructions provided by your insurance company. Understanding the claims process in advance can help to ensure that you are prepared to take the necessary steps in the event of an accident.

Benefits of Accident Insurance

Accident insurance provides financial protection in the event of unexpected incidents that result in injury or disability. One of the main benefits of accident insurance is the peace of mind it offers. Knowing that you have coverage in place can alleviate the financial stress that can often come with unforeseen accidents. This can allow you to focus on your recovery without worrying about the costs associated with medical treatment and rehabilitation.

Another key benefit of accident insurance is the flexibility it provides. Unlike traditional health insurance, accident insurance payouts can be used for any purpose, whether it’s covering medical bills, paying for household expenses while you recover, or even taking a vacation to aid in your recuperation. This flexibility can be invaluable in helping you maintain your quality of life during a difficult time.

In addition, accident insurance can provide additional financial support to complement your existing coverage. If you have high deductibles or co-pays with your health insurance, accident insurance can help bridge the gap and ensure that you are not left with a large financial burden. It can also provide a lump-sum payment for disabilities or dismemberment that is not covered by traditional health insurance.

Furthermore, accident insurance covers a wide range of accidents, from slips and falls to more serious incidents such as car accidents. This comprehensive coverage means that you are protected no matter how the accident occurs, giving you peace of mind in various situations. Overall, accident insurance provides an additional layer of financial security that can prove invaluable in the event of an unexpected injury.

Types of Accident Insurance Coverage

Accident insurance coverage comes in various types to cater to different needs. The most common type is the individual accident insurance, which provides coverage for the insured person in case of an accident. This type of insurance can be customized based on the specific needs and budget of the individual. It provides financial protection in the form of compensation for medical expenses, disability, and even death resulting from an accident.

Another type of accident insurance coverage is group accident insurance, which is often offered by employers to their employees as part of their benefits package. This type of coverage provides protection to a group of individuals who are affiliated with a particular organization. It typically includes benefits such as accidental death and dismemberment, disability income, and medical expense reimbursement.

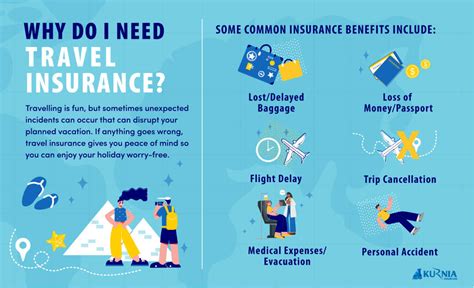

Furthermore, there is travel accident insurance which provides coverage for accidents that occur while traveling. This type of coverage is crucial for frequent travelers as it offers protection against unforeseen accidents that can happen during a trip, such as accidents while riding a taxi, being involved in a car crash, or while participating in adventurous activities.

Additionally, occupational accident insurance is designed to protect employees who are at higher risk of accidents due to their occupation. This type of insurance is typically found in industries such as construction, manufacturing, and transportation. It provides benefits such as medical expenses, disability income, and even coverage for retraining or vocational rehabilitation if an employee is unable to return to their previous job role due to an accident.

Finally, child accident insurance is a type of coverage that is specifically designed to protect children from the financial impact of accidents. This insurance provides coverage for medical treatments, hospitalization, and even therapy if a child is involved in an accident. It offers peace of mind to parents knowing that their child’s healthcare needs will be taken care of in the event of an unexpected accident.

Choosing the Right Accident Insurance Policy

When it comes to choosing the right accident insurance policy, there are a few key factors to consider. The first step is to assess your individual needs and potential risks. Consider your occupation, lifestyle, and any recreational activities you participate in. This will help determine the level of coverage you require.

Next, research the different types of accident insurance policies available. There are various options to choose from, including individual policies, group policies, and supplemental policies. Each type has its own advantages and limitations, so it’s important to carefully review your options.

Additionally, take the time to compare the coverage limits and exclusions of each policy. Make sure the policy provides adequate coverage for potential medical expenses, lost wages, and other financial burdens resulting from an accident. It’s also crucial to understand what specific events are covered, as well as any exclusions or limitations.

Consider seeking the advice of a licensed insurance agent to help you navigate the available options and find the best policy for your unique needs. An agent can provide valuable insight and help you understand the fine print of different policies. Remember, the goal is to choose a policy that provides the necessary protection and peace of mind in the event of an accident.

Making a Claim for Accident Insurance

Accidents are unforeseen events that can cause physical and financial strain. This is where Accident Insurance comes into play. It provides financial protection to individuals and families in the event of an accident. When the unfortunate happens, and an individual needs to make a claim for accident insurance, there are important steps to follow to ensure a smooth and successful process.

Making a claim for accident insurance requires the insured individual to provide documentation and evidence of the accident. This could include police reports, medical records, and any other relevant documents that support the claim. It is important to gather and submit these documents promptly to avoid delays in the claims process.

Once the necessary documentation has been gathered, the insured individual must notify their insurance provider of the accident and the intent to make a claim. This can usually be done through a phone call or online portal. It is important to provide accurate and detailed information about the accident to the insurance company to ensure that the claim is processed efficiently.

After the claim has been submitted, the insurance company will review the documentation and investigate the circumstances of the accident. This may involve interviews, assessments, and inspections to validate the claim. The insurer will then determine the validity of the claim and the amount of compensation that will be provided to the insured individual.

Once the claim has been approved, the insured individual will receive the compensation according to the terms of their accident insurance policy. This could be in the form of a lump sum payment or ongoing financial support, depending on the nature and severity of the accident.