This blog post thoroughly explores the question, What is gap insurance? providing readers with a comprehensive overview of its definition and significance in vehicle financing. It explains how gap insurance protects car owners from financial loss when their car is totaled or stolen, covering the difference between the vehicle’s actual cash value and the remaining loan balance. The article compares different types of gap insurance, outlines their advantages and disadvantages, and offers guidance on choosing the right policy. Real-life scenarios highlight situations where gap insurance proves beneficial, emphasizing its importance for vehicle owners. In the final thoughts, readers are encouraged to make informed decisions when selecting gap insurance, ensuring financial security in unexpected circumstances. This resource aims to equip car buyers with essential knowledge to answer the question: What is gap insurance and its relevance in today’s automobile landscape?

Understanding Gap Insurance: A Comprehensive Overview

Contents

- 1 Understanding Gap Insurance: A Comprehensive Overview

- 2 What Is Gap Insurance And Why Is It Important?

- 3 How Gap Insurance Works During Vehicle Financing

- 4 Types of Gap Insurance: A Comparison Guide

- 5 Advantages and Disadvantages of Gap Insurance

- 6 How to Choose the Right Gap Insurance Policy

- 7 Real-Life Scenarios: When Gap Insurance Pays Off

- 8 Final Thoughts on Choosing Gap Insurance Wisely

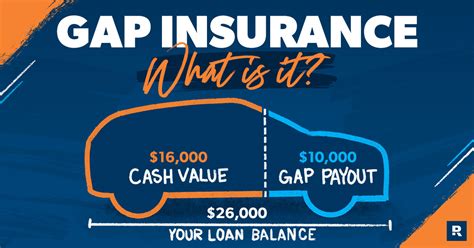

Gap insurance is an essential coverage type designed to protect vehicle owners from financial loss in the event of a total loss accident. This insurance caters specifically to those who have financed or leased a vehicle. When we refer to what is gap insurance, we are highlighting its role in covering the difference—or gap—between the actual cash value of a car at the time of an accident and the amount owed on its financing or lease. Understanding this concept is crucial for any individual looking to safeguard their financial investments against unforeseen circumstances.

When a vehicle is deemed a total loss, the insurance payout typically reflects the car’s market value rather than its outstanding loan amount. This disparity can lead to considerable financial hardship for the car owner. Consequently, gap insurance becomes a valuable safety net. Vehicle owners should consider obtaining this coverage especially when purchasing a new or leased vehicle to mitigate potential financial risks effectively.

| Type of Insurance | Coverage Amount | Recommended For |

|---|---|---|

| Standard Auto Insurance | Actual Cash Value | All vehicle owners |

| Gap Insurance | Difference between loan balance and market value | Financed or leased vehicles |

| Comprehensive Insurance | Full value; includes theft and damages | All vehicle owners |

| Liability Coverage | Injury or damage to others | All vehicle owners |

Understanding the types of coverage available is vital for making informed decisions. Choosing the right insurance requires weighing the costs of premium payments against potential out-of-pocket expenses if a total loss occurs. It is also essential to grasp the advanced features that gap insurance may offer in combination with other policies.

- Key Features of Gap Insurance

- Covers the difference between the vehicle’s value and the loan balance.

- Available for both new and leased cars.

- Typically a one-time premium or added to existing coverage.

- Helps avoid negative equity situations.

- Can often be purchased through dealerships or insurance providers.

- Recommend for those with little to no down payment.

In summary, what is gap insurance, if not a financial safeguard in the face of unforeseen accident-related losses? For those who finance or lease their vehicles, this type of insurance is not only a smart choice but often a necessary one. It provides peace of mind knowing that you won’t be left with a financial burden amid such unfortunate circumstances.

What Is Gap Insurance And Why Is It Important?

What is gap insurance? It is a specialized type of car insurance designed to cover the difference between what you owe on your vehicle and its current market value, especially in cases of theft or a total loss due to an accident. When you purchase a new car, its value tends to depreciate significantly the moment it is driven off the lot. Without gap insurance, you may find yourself in a financially precarious position, having to pay off a loan for a vehicle that is no longer in your possession.

Many car buyers misunderstand the need for gap insurance, especially if they have traditional auto insurance. However, these policies typically only cover the vehicle’s current market value. This gap can leave individuals financially exposed, making it vital to understand the role gap insurance plays in protecting your investment. As such, knowing what is gap insurance helps you make informed decisions about your coverage needs.

| Loan Amount | Market Value | Gap Amount |

|---|---|---|

| $25,000 | $20,000 | $5,000 |

| $28,000 | $25,000 | $3,000 |

| $40,000 | $30,000 | $10,000 |

Understanding what is gap insurance also involves recognizing its benefits. It can provide peace of mind by ensuring that you don’t have to bear the financial burden if your vehicle is suddenly rendered worthless. Essentially, it serves as a safety net, allowing you to drive without the looming fear of financial loss. To clarify the advantages, here are some key benefits of gap insurance:

- Protects against significant losses in case of total vehicle loss

- Covers the remaining balance on your auto loan

- Provides peace of mind while driving your new vehicle

- Often required by lenders for leased vehicles

- Helps ensure you’re not left with debt after a loss

- Can potentially save you money in the long run

In conclusion, the question of what is gap insurance and its importance cannot be understated. This insurance can be a financial lifesaver, offering invaluable protection during a time of stress and loss. By understanding the risks involved and the coverage options available, you are better equipped to make sound decisions regarding your car insurance needs.

How Gap Insurance Works During Vehicle Financing

What is gap insurance? It serves as a crucial financial safety net for vehicle owners who are financing or leasing their cars. When you purchase a car, its value diminishes over time, falling significantly within the first few years. If your vehicle is totaled or stolen, your standard auto insurance typically covers the current market value of the vehicle, which may be less than what you owe on your financing. This is where gap insurance comes into play, covering the ‘gap’ between your car’s actual value and the remaining balance on your loan or lease.

Understanding how gap insurance applies during vehicle financing can protect you from unexpected financial burdens. This insurance can be a lifesaver, especially if you’re financing a new or high-value vehicle. Essentially, it ensures that you’re not left with mounting debt after an unfortunate event, allowing you to focus on replacing your vehicle rather than worrying about financial strain.

| Insurance Type | Coverage Description | When to Use |

|---|---|---|

| Lease Gap Insurance | Covers the difference between what you owe on a lease and the car’s market value. | During or after a lease if car is declared a total loss. |

| Loan Gap Insurance | Covers the gap between the loan balance and the insurance payout after a total loss. | When financing a new or depreciating vehicle. |

| Standard Insurance | Covers the current market value of the vehicle only. | For basic vehicle insurance, less applicable for new vehicles. |

When looking to claim your gap insurance, understanding the steps to take can simplify the process. Below are essential steps that form a clear pathway to ensuring that you secure the necessary coverage:

Steps to Claim Gap Insurance

- Contact your auto insurance provider to report the incident.

- Statement of Loss: Obtain a proper statement from your insurer indicating the market value payout.

- Collect necessary documentation like your financing agreement and insurance paperwork.

- Reach out to your gap insurance provider to initiate the claim.

- Fill out the required claim forms accurately.

- Submit all documentation as requested by the gap insurance company.

- Follow-up to ensure your claim is being processed.

Process of Filing a Claim

Filing a claim for gap insurance involves a series of steps to ensure that you’re adequately compensated. First, reporting the incident to your auto insurer is crucial. They will assess the situation and determine the value of your vehicle. Once you receive the payout from your primary insurance, the gap insurance provider will require documentation such as the loss statement and your financing details. It’s essential to keep accurate records throughout this process, ensuring all paperwork is completed and submitted for a smooth claim experience.

Eligibility Criteria for Coverage

Not all vehicle owners are automatically eligible for gap insurance. Typically, the eligibility criteria include being in a financing agreement or leasing your vehicle. Furthermore, the vehicle’s value must be less than the outstanding balance on your loan; otherwise, there would be no ‘gap’ to cover. It’s also important to consider the specific terms outlined in your gap insurance policy, as each provider may have unique qualifications and limitations. Always review these criteria before securing a gap insurance policy to ensure you’re making an informed decision.

Types of Gap Insurance: A Comparison Guide

Understanding the different types of gap insurance is essential for making an informed decision regarding your vehicle financing or leasing options. What is gap insurance? It is a type of coverage that helps protect vehicle owners by covering the difference between the amount owed on a finance agreement and the vehicle’s current market value in the event of a total loss. Let’s explore the various types of gap insurance available to help you determine which option may be best for your unique situation.

There are several types of gap insurance policies catered to specific financing arrangements and vehicle circumstances. These gaps in insurance can vary in coverage and applicability, making it crucial to understand each type before committing. To provide clarity, we have outlined the different types of gap insurance below.

Types of Gap Insurance

- Finance Gap Insurance

- Leasing Gap Insurance

- Total Loss Gap Insurance

- Inventory Gap Insurance

- Negative Equity Gap Insurance

- New Vehicle Gap Insurance

| Type of Gap Insurance | Best For | Coverage Details |

|---|---|---|

| Finance Gap Insurance | Car buyers with a loan | Covers the difference between the loan balance and market value. |

| Leasing Gap Insurance | Leased vehicles | Protects against the gap between what you owe on the lease and the vehicle’s worth. |

| Total Loss Gap Insurance | Vehicles declared a total loss | Covers the gap if the car is totaled and the payout is less than the owed amount. |

| Negative Equity Gap Insurance | Used vehicles with a loan | Covers the negative equity in cases where a vehicle has depreciated faster than the loan balance. |

As you review the different types of gap insurance, it’s important to note that each type has its own features and limitations. This makes it essential for consumers to assess their financial situation and the specific arrangements they have concerning their vehicle. Understanding these distinctions can guide you toward selecting the most appropriate coverage for your needs.

Finance Gap Insurance

Finance gap insurance is designed primarily for individuals who purchase vehicles through financing. This type of coverage covers the outstanding balance on the loan if the vehicle is deemed a total loss. Many lenders require this insurance to ensure that consumers are protected in case of unexpected circumstances. By having finance gap insurance, you avoid the risk of being underwater on your loan, which means owing more than the car’s worth.

Leasing Gap Insurance

When leasing a vehicle, gap insurance is not just an option—it is often recommended. Leasing gap insurance protects the lessee from the financial burden of a total loss. Since leased vehicles usually have lower market values than what the lessee owes at the time of loss, this type of gap insurance becomes crucial. With leasing gap insurance, you mitigate the financial risks associated with possible accidents or theft.

Total Loss Gap Insurance

Total loss gap insurance serves as a vital safety net for car owners in the unfortunate event of a total loss. This type of insurance ensures that in case your vehicle is totaled, the payout you receive from your auto insurance will be supplemented to cover the difference between the insurance settlement and what you still owe on your finance agreement. Without total loss gap insurance, vehicle owners might face severe financial repercussions when trying to replace their vehicles.

Advantages and Disadvantages of Gap Insurance

Gap insurance is an essential coverage for those who are financing or leasing a vehicle. It serves to protect the consumer from financial losses in the event of a total loss of their vehicle. Understanding what it entails can lead to informed decisions on whether or not to secure this type of protection. While it can offer significant benefits, such as covering the difference between the car’s value and what you owe, it also comes with considerations that potential policyholders should be aware of.

The dynamics of gap insurance reflect both its advantages and disadvantages. As many car owners may not fully understand the implications of such coverage, it’s imperative to weigh its benefits against possible downsides. Before diving into these aspects, examining the financial context of gap insurance is helpful to appreciate its necessity or shortcomings.

| Advantages | Disadvantages | Considerations |

|---|---|---|

| Covers the gap between what you owe and the car’s actual cash value | Can be an additional cost to car ownership | Consider your financial stability |

| Provides peace of mind during vehicle financing | Not required by law | Evaluate your financing terms |

| Helps avoid unexpected out-of-pocket expenses | May overlap with existing insurance coverage | Assess existing coverage limits |

In the complex landscape of automotive insurance, understanding how gap insurance functions relative to other coverage types is crucial. Many consumers find themselves unprepared when their vehicle is deemed a total loss. To facilitate clarity, here are some Pros and Cons of Gap Insurance that will help you make an informed choice:

- Pros: Covers the difference between loan/lease balance and insurance payout.

- Pros: Offers financial protection for recently purchased vehicles.

- Pros: Provides reassurance for those who finance their cars.

- Cons: Can lead to extra monthly expenses.

- Cons: Might not be necessary for all vehicle owners.

- Cons: Possible duplication with comprehensive coverage.

Detailed Overview of Pros and Cons

Evaluating the pros and cons of gap insurance gives you the insight needed to determine its relevance to your individual financial situation. Those who suffer a total loss of their vehicle can feel the impact on their wallet, especially in cases where they owe more than the car is currently worth. The advantages provide a buffer against such financial difficulties.

Understanding the full scope of gap insurance, including both advantages and challenges, is key to eligible decision-making.

How to Choose the Right Gap Insurance Policy

When considering what is gap insurance, it’s essential to understand how to select the right policy to safeguard your financial interests. Gap insurance helps cover the difference between what you owe on your vehicle and its actual cash value in the event of a total loss. By choosing the correct policy, you can rest easy knowing you are protected from unexpected financial burdens.

To determine the most suitable gap insurance policy, start by evaluating your needs. Assess factors such as the total cost of your vehicle, the amount financed, and the depreciation rate. It’s crucial to choose a policy that offers adequate coverage for your situation, ensuring that you are not left with outstanding payments after an accident.

| Policy Feature | Description | Importance |

|---|---|---|

| Coverage Amount | The total sum covered by the policy. | Ensures full protection of your investment. |

| Premium Costs | The monthly or yearly amount paid for the policy. | Affects your overall budget. |

| Claim Process | The procedure for filing a claim. | Impacts how easily you can access your benefits. |

After evaluating your personal needs and understanding policy features, you can move on to the Steps to Select Gap Insurance. This systematic approach ensures that you choose a policy that aligns with your requirements and offers peace of mind.

- Research gap insurance providers to find reputable companies.

- Compare coverage options and features among different policies.

- Check the premium costs and make sure they fit your budget.

- Evaluate the claim process for ease and efficiency.

- Consider customer reviews to gauge satisfaction levels.

- Seek recommendations from trusted sources or professionals.

- Review the fine print for exclusions and specific conditions.

Ultimately, understanding what is gap insurance and its implications on your finances is key to selecting a suitable policy. Make an informed decision by analyzing your situation and following the logical steps outlined above. This strategic approach will empower you to secure the best protection for your vehicle investment.

Real-Life Scenarios: When Gap Insurance Pays Off

Understanding what is gap insurance becomes crucial when we consider its real-life applications. This type of coverage can provide significant financial relief in situations where the value of your vehicle falls short of the amount you owe on your auto loan. Essentially, gap insurance acts as a financial safety net for car buyers, especially those who finance their vehicles. Let’s explore some scenarios in which gap insurance is invaluable.

It’s essential to recognize that gap insurance can be a lifesaver under specific circumstances. For instance, if your vehicle is totaled in an accident shortly after purchase, the insurance payout may only cover the current market value of the car, which is often less than what you owe. In such cases, your gap insurance can ensure that you are not left in debt after a total loss. The following table illustrates the difference in payments with and without gap insurance in common situations:

| Scenario | Insurance Payout | Amount Owed |

|---|---|---|

| Total Loss within 6 months | $15,000 | $20,000 |

| Minor Accident (Repairable) | $8,000 | $10,000 |

| Total Loss after 1 year | $12,000 | $18,000 |

Moreover, various situations can lead to claiming gap insurance. Buyers may not always anticipate these scenarios at the time of purchase. Here is a list of common situations that may warrant a gap insurance claim:

- Common Situations for Claiming Gap Insurance

- New vehicle purchase with a loan

- Accidents resulting in total loss

- Negative equity in trade-ins

- Vehicle theft

- Rapid depreciation of the vehicle

- Returning a leased vehicle early

In essence, understanding what is gap insurance and its benefits is critical for any car owner, especially those who have taken out loans or lease agreements. It provides peace of mind knowing that you are financially protected from losses that can occur beyond your control. The scenarios discussed here highlight the financial advantages that gap insurance can provide during unfortunate events, ensuring you are not left stuck with unexpected debt.

Final Thoughts on Choosing Gap Insurance Wisely

In conclusion, understanding what is gap insurance is crucial for making informed decisions regarding your vehicle financing. Gap insurance can be a valuable safeguard against financial loss, particularly in situations where your vehicle is stolen or totaled. However, selecting the right policy requires careful consideration of your specific circumstances, such as the vehicle’s value, your financial situation, and your post-accident needs.

When pondering what is gap insurance, it is vital to evaluate the options available to you. Compare multiple policies and providers to determine which one aligns best with your financial situation and risk tolerance. Don’t hesitate to ask questions and seek clarifications about the coverage, exclusions, and the claims process before making a commitment.

| Criteria | Standard Gap Insurance | Lease Gap Insurance |

|---|---|---|

| Best for | Car buyers who own their vehicles | Individuals leasing a vehicle |

| Coverage Type | Difference between loan balance and current vehicle value | Difference between lease pay-off amount and current vehicle value |

| Typical Duration | Until the vehicle is paid off | During the entire lease period |

Moreover, consumers should keep in mind several essential points when selecting a gap insurance policy. It’s not just about the cost; understanding the coverage details can save you from potential financial pitfalls down the road. Obtaining clarity on terms and conditions can significantly impact your overall satisfaction with the policy, especially during claim scenarios.

Key Takeaways for Gap Insurance Selection

- Assess your financial situation and the risk of depreciation.

- Understand the difference between standard and lease gap insurance.

- Compare quotes and policy terms from multiple providers.

- Review coverage limits and any exclusions thoroughly.

- Consider the duration of your loan or lease to avoid redundant coverage.

- Don’t rush the decision—take the time to choose wisely.

Ultimately, grasping what is gap insurance and how it applies to your unique scenario can be a game-changer in protecting your investment. By arming yourself with knowledge and resources, you can select a policy that not only meets your needs but also provides peace of mind on the road ahead.

No comment