This blog post provides an in-depth look at what is supplemental health insurance and its significance in enhancing overall health coverage. It explains how supplemental health insurance works and outlines various types of policies available for individuals seeking additional coverage. Readers will discover key benefits, such as filling the gaps in traditional health plans, and factors to consider when choosing a policy. The article also dispels common misconceptions about supplemental health insurance, offering practical tips for maximizing benefits. Finally, it encourages readers to take actionable steps toward informed decisions about their health insurance needs, ensuring they are adequately protected. Overall, this comprehensive guide answers the critical question: what is supplemental health insurance?

Understanding The Importance Of Supplemental Health Insurance

Contents

- 1 Understanding The Importance Of Supplemental Health Insurance

- 2 What Is Supplemental Health Insurance And How It Works

- 3 Types Of Supplemental Health Insurance Policies To Consider

- 4 Key Benefits Of Supplemental Health Insurance Plans

- 5 Factors To Evaluate When Choosing Supplemental Health Insurance

- 6 Common Misconceptions About Supplemental Health Insurance

- 7 Practical Tips For Maximizing Your Supplemental Health Insurance Benefits

- 8 Final Thoughts And Actionable Steps On Supplemental Health Insurance

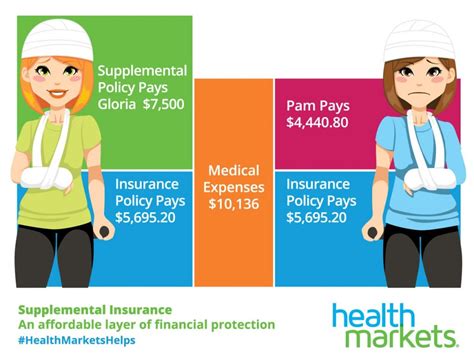

When exploring healthcare options, many individuals wonder what is supplemental health insurance and how it can fortify their existing health coverage. This additional layer of insurance is not just a luxury; it’s a strategic safeguard against the high costs of medical care that basic insurance may not fully cover. Supplemental health insurance plans serve as a crucial financial buffer, ensuring that unexpected medical expenses do not jeopardize your financial stability.

These policies play a vital role in covering out-of-pocket expenses, co-payments, and treatments that primary insurance might overlook. Understanding what is covered by supplemental health insurance is essential. Typically, these plans provide benefits that can include hospital stays, preventative services, dental, and vision care, among others. They offer peace of mind, knowing that there’s a safety net when faced with significant health-related costs.

| Type of Supplemental Insurance | Coverage Provided | Typical Cost Range |

|---|---|---|

| Medicare Supplement | Fills gaps in Medicare coverage | $100 – $300/month |

| Critical Illness Insurance | Provides a lump sum for serious illnesses | $50 – $300/month |

| Dental and Vision Insurance | Covers routine check-ups and treatments | $20 – $60/month |

| Accident Insurance | Financial support for accident-related injuries | $15 – $50/month |

In addition to understanding the various types of supplemental health insurance, it is vital to recognize the compelling reasons for considering these policies. Here are some Key Reasons To Consider Supplemental Health Insurance:

- Provides tailored coverage that fits individual health needs.

- Helps mitigate the high costs of unexpected medical events.

- Offers better peace of mind during critical health situations.

- Covers specific areas typically excluded from primary insurance.

- Enhances overall healthcare access and options.

- Can be more cost-effective in the long term for frequent health issues.

Ultimately, understanding what is supplemental health insurance can empower consumers to make informed decisions about their health coverage. By evaluating your healthcare needs and financial goals, it becomes evident how supplemental health insurance can add significant value. In a world where unforeseen medical circumstances can arise, having this type of insurance may very well be a prudent investment in your long-term health and financial security.

What Is Supplemental Health Insurance And How It Works

Supplemental health insurance is an additional coverage designed to work alongside your primary health insurance policy. This type of insurance can help cover out-of-pocket expenses, routine and preventive care, and various other medical costs that your primary plan may not fully pay. Understanding what is supplemental health insurance is essential for navigating the complexities of healthcare costs effectively.

This coverage can provide financial assistance for copayments, deductibles, and co-insurance fees. By filling in the gaps left by standard health insurance policies, supplemental health insurance can serve as a crucial safeguard against unexpected medical expenses. This not only helps to alleviate financial stress but also ensures that you can access necessary medical services without hesitation.

| Type | Coverage Includes | Who Should Consider |

|---|---|---|

| Medicare Supplement (Medigap) | Hospital costs, doctor visits, and preventive care | Those over 65 or with certain disabilities |

| Critical Illness Insurance | Health issues like cancer or heart attacks | Individuals at high risk for serious health conditions |

| Accident Insurance | Injury-related costs and emergency care | Active individuals or those with riskier jobs |

| Dental and Vision Insurance | Routine exams, surgeries, and corrective lenses | Everyone, especially families with children |

Understanding the specific details of your supplemental health insurance policy can greatly enhance the benefits you receive. If you are unsure how it integrates with your current insurance, it is crucial to seek professional advice. Familiarizing yourself with the terms and coverage options can empower you to make informed decisions regarding your healthcare.

Steps To Understand Supplemental Health Insurance

- Identify your healthcare needs and budget.

- Research the different types of supplemental health insurance available.

- Review your primary health insurance policy thoroughly.

- Consult with insurance professionals to clarify options.

- Compare costs versus benefits of various supplemental policies.

- Choose the supplemental coverage that best addresses your needs.

- Regularly review your insurance coverage as your health needs evolve.

Supplemental health insurance can play a significant role in ensuring comprehensive medical coverage. By understanding what is supplemental health insurance and assessing your specific needs, you can significantly reduce financial burdens associated with healthcare costs. Always stay informed and proactive in managing your health insurance to maximize your benefits.

Types Of Supplemental Health Insurance Policies To Consider

When exploring options for health coverage, it’s crucial to look at the various types of supplemental insurance policies available. Understanding what these policies are can help you make informed decisions regarding your healthcare needs. Supplemental health insurance is designed to cover the gaps in traditional health insurance, such as deductibles, co-pays, and services not included in standard plans. By considering supplemental options, individuals can enhance their health security and financial peace of mind.

There are several types of supplemental health insurance policies that cater to specific needs and situations. Each policy offers distinctive benefits aimed at addressing particular financial burdens associated with healthcare expenses. When planning your supplemental coverage, it’s important to evaluate your health status and potential out-of-pocket costs. This insight will enable you to choose the most suitable supplemental plan for your circumstances.

| Policy Type | Coverage Details | Typical Cost |

|---|---|---|

| Critical Illness Insurance | Pays lump sum for specific illnesses | Moderate |

| Accident Insurance | Covers medical and out-of-pocket expenses due to accidents | Low |

| Hospital Indemnity Insurance | Provides cash benefits for hospitalization costs | Low to moderate |

| Long-Term Care Insurance | Covers care costs for chronic conditions over an extended period | High |

Selecting the right supplemental health insurance can be daunting, especially with the myriad of options available. Here’s a list of different types of supplemental policies to consider for your healthcare needs:

- Short-Term Disability Insurance

- Critical Illness Insurance

- Accident Insurance

- Hospital Indemnity Insurance

- Vision Insurance

- Dental Insurance

- Long-Term Care Insurance

Two popular types of supplemental health plans are Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Both options offer distinct features and could significantly impact your healthcare experience.

Health Maintenance Organizations

Health Maintenance Organizations typically require members to choose a primary care physician (PCP) and obtain referrals to see specialists. This structure can lead to lower out-of-pocket costs, making it an appealing option for many individuals. However, one of the drawbacks is that members have limited flexibility regarding healthcare providers, as they must use a network of designated doctors and facilities.

Preferred Provider Organizations

In contrast, Preferred Provider Organizations offer more freedom for members to see any healthcare provider, though utilizing the network of preferred providers results in lower costs. This flexibility is advantageous for those who wish to have more control over their healthcare options. However, it’s essential to weigh the potential for higher premium costs against the benefits of added choice.

Key Benefits Of Supplemental Health Insurance Plans

When considering health coverage, it’s essential to understand what supplemental health insurance entails. These plans not only fill gaps in traditional health insurance but also offer additional protection and financial support. The significance of knowing what is included in these plans cannot be overstated, as they can help alleviate the burden of unforeseen medical expenses.

Supplemental health insurance provides various advantages that enhance the overall security of your healthcare. For those already covered by a primary health plan, supplemental insurance can help manage costs for specific needs that aren’t fully covered. This makes it an attractive option for many, especially those who require frequent medical attention or specialized services.

| Type of Coverage | Description | Potential Benefits |

|---|---|---|

| Critical Illness Insurance | Offers a lump sum payment upon diagnosis of a severe illness. | Financial relief for out-of-pocket expenses. |

| Accident Insurance | Provides benefits for injuries resulting from accidents. | Covers costs not included in primary policies. |

| Hospital Indemnity Insurance | Gives a daily cash benefit for hospital stays. | Helps with lost income and other unexpected costs. |

| Medicare Supplement Insurance | Helps cover costs not paid by Medicare. | Minimizes out-of-pocket expenses for seniors. |

The benefits of having supplemental health insurance cannot be overlooked. There are several key advantages to consider when evaluating these plans:

- Benefits Of Supplemental Health Insurance

- Enhanced financial security for medical expenses

- Protection against high out-of-pocket costs

- Additional cash benefits during hospital stays

- Comprehensive coverage for critical illnesses

- Peace of mind knowing you’re adequately covered

- Access to a wider range of healthcare services

In conclusion, understanding what is covered under supplemental health insurance plans provides a clearer picture of their benefits. They can serve as a crucial financial safety net, helping individuals and families manage unexpected health-related costs. As you evaluate your healthcare options, consider how supplemental plans can complement your existing coverage and enhance your overall health security.

Factors To Evaluate When Choosing Supplemental Health Insurance

When considering supplemental health insurance, it’s crucial to evaluate various factors to ensure you select a policy that meets your unique healthcare needs. Understanding your personal requirements and financial situation can significantly influence your choice. The right supplemental plan should not only enhance your existing health coverage but also provide peace of mind during unexpected medical events. As you delve into this decision, several key elements require your careful attention.

One primary aspect of your evaluation should be the cost associated with supplemental health insurance. It’s essential to compare premiums, deductibles, and out-of-pocket expenses to gauge affordability. Remember that while a lower premium may seem appealing, it could come with higher out-of-pocket costs when you need care. Balancing cost with quality coverage is critical to making an informed decision.

| Plan Type | Monthly Premium | Average Deductible |

|---|---|---|

| Medigap | $150 | $200 |

| Critical Illness Insurance | $120 | $100 |

| Accident Insurance | $80 | $50 |

Coverage options are another vital consideration. A comprehensive supplemental health insurance plan should integrate seamlessly with your existing coverage, filling in the gaps where primary insurance may fall short. It’s important to closely examine the different types of services and treatments included in a plan. Specifically, look for policies that cover essential services relevant to your medical needs, including specialist visits, hospitalization, and prescription drugs.

Cost Factors

Cost factors encompass more than just the monthly premium. You should also take into account possible increases over time and whether the plan locks in rates for a certain period. Some plans might offer additional benefits that could justify higher costs, such as better coverage for specific health issues or wellness programs. Understanding how these cost factors work together can greatly impact your long-term financial health.

Coverage Options

When evaluating coverage options, it’s imperative to explore the extent of services provided. For instance, does the plan cover preventative care, or does it focus primarily on emergency medical situations? Always review exclusions and limitations meticulously. Additionally, consider if the plan allows for flexibility in choosing healthcare providers. This can significantly affect your access to quality care when you need it most.

Considerations For Choosing A Plan

- Assess your current health status and healthcare needs.

- Evaluate your budget and financial readiness.

- Compare multiple policies and their coverage limits.

- Examine the provider network associated with each plan.

- Check for any pre-existing condition clauses.

- Ensure the plan aligns with your long-term health goals.

- Read customer reviews and rate the insurer’s reputation.

In choosing supplemental health insurance, knowledge is power. Being informed about cost factors and coverage options can guide your selection process, ensuring optimal protection.

Common Misconceptions About Supplemental Health Insurance

When exploring the subject of supplemental health insurance, many individuals hold onto several misconceptions that can cloud their understanding of its purpose and benefits. One of the primary misunderstandings relates to the notion that supplemental insurance is a replacement for primary health insurance. In reality, supplemental health insurance is designed to enhance your existing health coverage, filling gaps that might otherwise leave you vulnerable to high out-of-pocket costs.

Another common misconception is that supplemental health insurance is only for those with specific health conditions. This belief can lead many to overlook the advantages it offers for a broader demographic, including those seeking peace of mind and greater financial security. Supplemental policies can provide coverage for various medical expenses, which include but are not limited to vision, dental, and accidental injury.

| Type of Coverage | Examples | Who Should Consider? |

|---|---|---|

| Dental Insurance | Routine exams, fillings | Anyone needing dental care |

| Vision Insurance | Eye exams, glasses | Individuals requiring glasses or contacts |

| Accident Insurance | Emergency treatments | Active individuals or families |

Moreover, many people mistakenly believe that enrolling in supplemental health insurance is overly complicated or only offers minimal benefits. In truth, the process can vary from straightforward applications to comprehensive policies that provide substantial coverage enhancements. Understanding how these plans align with your current coverage is crucial in determining their true value.

Frequently Misunderstood Aspects

- Supplemental insurance is not a replacement for primary insurance.

- It benefits a wide range of individuals, not just those with pre-existing conditions.

- Enrollment processes can be simpler than presumed.

- Supplemental policies can cover various areas, including dental and vision.

- These plans can provide significant financial relief during unexpected health events.

- They often vary in cost, allowing for options that fit different budgets.

Understanding the realities behind supplemental health insurance is essential for making informed decisions about your health care options. By recognizing these misconceptions, you position yourself better to utilize supplemental policies effectively, ensuring comprehensive coverage and financial stability in the long run.

Practical Tips For Maximizing Your Supplemental Health Insurance Benefits

When exploring the topic of what is supplemental health insurance, it’s vital to understand how to make the most of your policy. Supplemental health insurance can bridge the gap between standard health insurance and out-of-pocket costs, providing crucial financial support for various medical expenses. However, many individuals are unaware of the full range of benefits available to them. By knowing how to effectively utilize these policies, you can maximize your financial protection and access to healthcare services.

One of the most significant strategies in maximizing your supplemental health insurance benefits is to stay informed about your policy details. This means regularly reviewing your insurance documents to ensure you understand what is covered and the specific conditions required for benefits to be disbursed. Having a clear understanding of your plan can help you avoid unnecessary expenses and administrational issues. It is also beneficial to reach out to your insurance provider to clarify any confusing terms or coverage limits.

| Type of Coverage | Description | Typical Benefits |

|---|---|---|

| Critical Illness Insurance | Provides a lump-sum payment upon diagnosis of a critical illness. | Financial support for treatment and recovery. |

| Accidental Injury Insurance | Covers medical expenses related to injuries from accidents. | Helps pay for hospital stays, surgeries, and rehabilitation. |

| Hospital Indemnity Insurance | Pays a fixed daily or weekly benefit for hospital confinement. | Offsets costs like transportation and medication during hospital stays. |

| Long-Term Care Insurance | Covers costs for services that assist with daily living activities. | Supports expenses related to nursing homes or in-home care. |

Another important aspect to consider is the coordination of benefits between your main health insurance and your supplemental policy. Make sure to file claims correctly and keep detailed records of all medical services received. This practice not only helps prevent misunderstandings but also ensures that you receive all entitled benefits promptly. It’s also wise to develop a habit of asking your healthcare provider how your treatments and services align with your supplemental insurance policy.

Steps To Maximize Benefits

- Understand the specifics of your plan.

- Communicate proactively with your insurance provider.

- Keep an organized record of all medical expenses.

- Ensure claims are submitted correctly and timely.

- Regularly review your plan to reassess your needs.

- Stay updated on any changes to policy or coverage limits.

- Utilize preventive services whenever possible.

Maximizing your supplemental health insurance benefits requires diligence and awareness of your coverage options.

By adopting these practical strategies, you’ll be better equipped to navigate your supplemental health insurance policy successfully. This proactive approach can lead to significant cost savings and peace of mind knowing you have financial backing for unexpected health-related expenses. Remember, informed decisions lead to greater benefits when facing medical challenges.

Final Thoughts And Actionable Steps On Supplemental Health Insurance

In conclusion, understanding what is supplemental health insurance is pivotal for making informed health care decisions. It provides additional financial support that can significantly reduce out-of-pocket expenses. Whether you’re facing unexpected medical emergencies or planning for ongoing health care needs, knowing the intricacies of these policies can help you navigate your options better.

Moreover, consider evaluating your current health needs and financial situation to see how supplemental health insurance fits into your overall health insurance strategy. It is advisable to analyze various plans and their benefits thoroughly. Engaging with an insurance advisor can further enhance your understanding of how these policies work and guide you in selecting the right coverage tailored to your needs.

| Policy Type | Coverage Details | Ideal For |

|---|---|---|

| Medicare Supplement Plans | Covers costs not included in Medicare, such as deductibles and co-payments. | Seniors on Medicare seeking additional coverage. |

| Critical Illness Insurance | Provides lump-sum payments upon diagnosis of serious conditions. | Individuals at higher risk for severe health issues. |

| Accident Insurance | Offers cash benefits for unexpected accidents, including hospital visits. | Active individuals prone to injuries. |

| Hospital Indemnity Insurance | Provides daily cash benefits while hospitalized, regardless of primary insurance. | Anyone needing additional financial coverage for hospitalization. |

Now that you have a clearer view of what supplemental health insurance entails, it’s crucial to take proactive steps. Setting immediate personal health goals and establishing a budget can streamline your search for appropriate policies. Moreover, recognizing the limitations of your primary insurance plan can illuminate the necessity for supplementary coverage.

Key Takeaways

- Understand the Basics: Comprehending what is supplemental health insurance is essential for sound decision-making.

- Evaluate Your Needs: Assess your health care requirements to identify gaps that supplemental insurance can fill.

- Research Plans: Invest time in analyzing different supplemental health insurance plans available in your area.

- Consult Professionals: Seek guidance from insurance advisors to clarify complex terms and options.

- Budget Wisely: Determine how much you can afford to allocate for supplemental health insurance premiums.

- Stay Informed: Keep up with updates regarding your primary health coverage and how they affect supplemental plans.

By following these actionable steps, you can enhance your understanding of supplemental health insurance, enabling you to make smarter, well-informed choices about your health care strategy.

No comment